Personne décroche

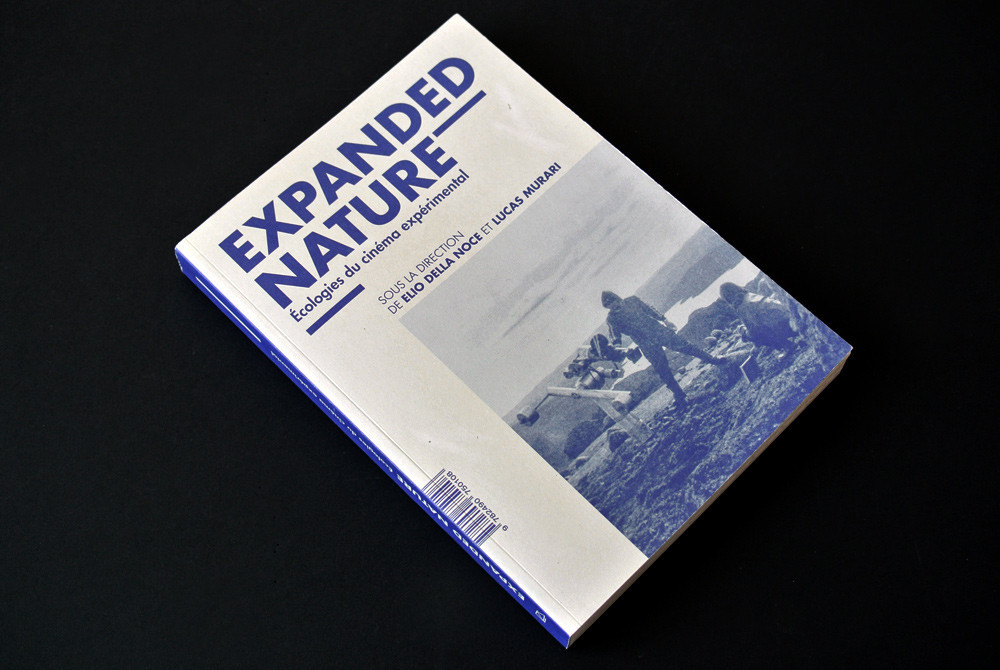

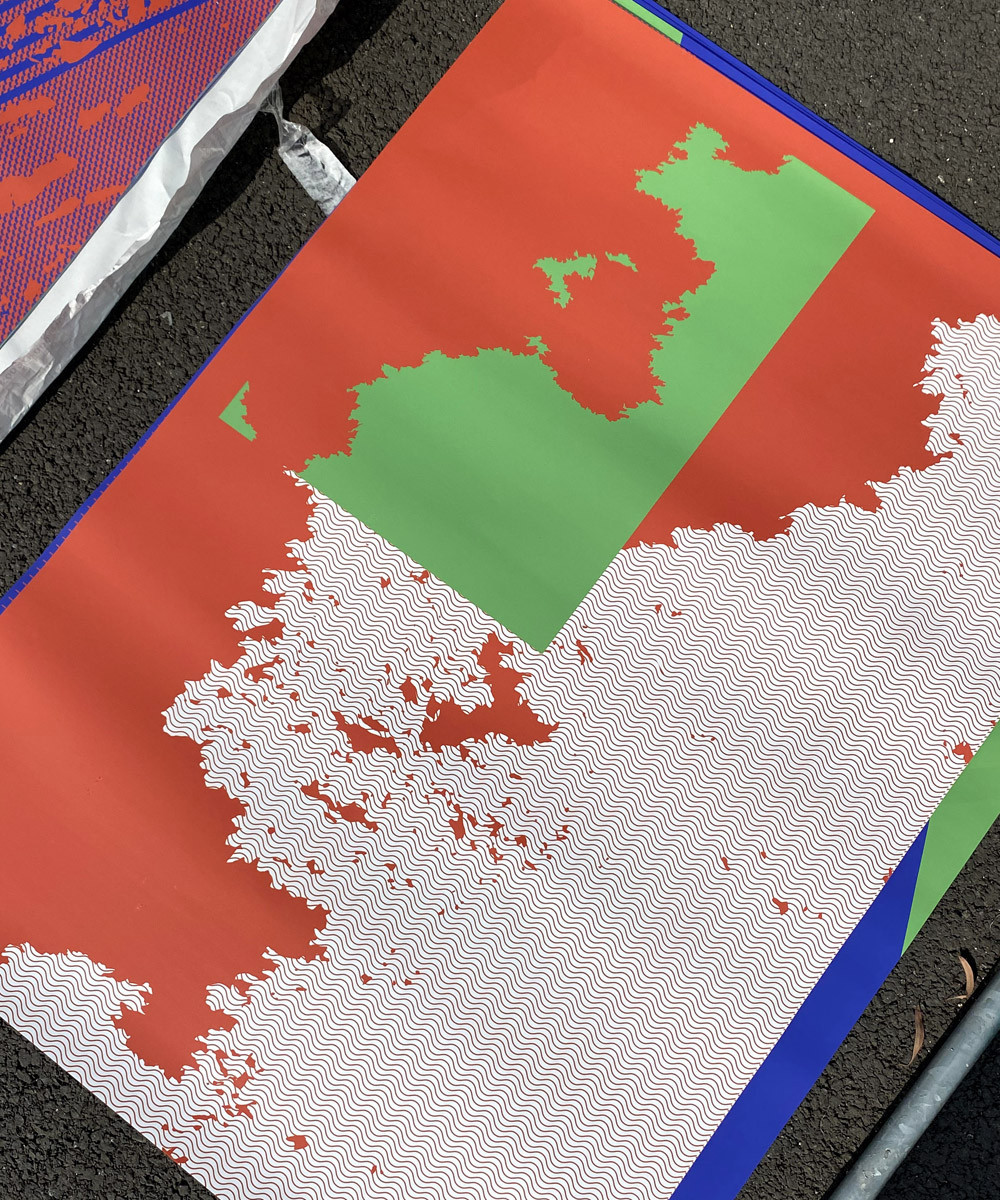

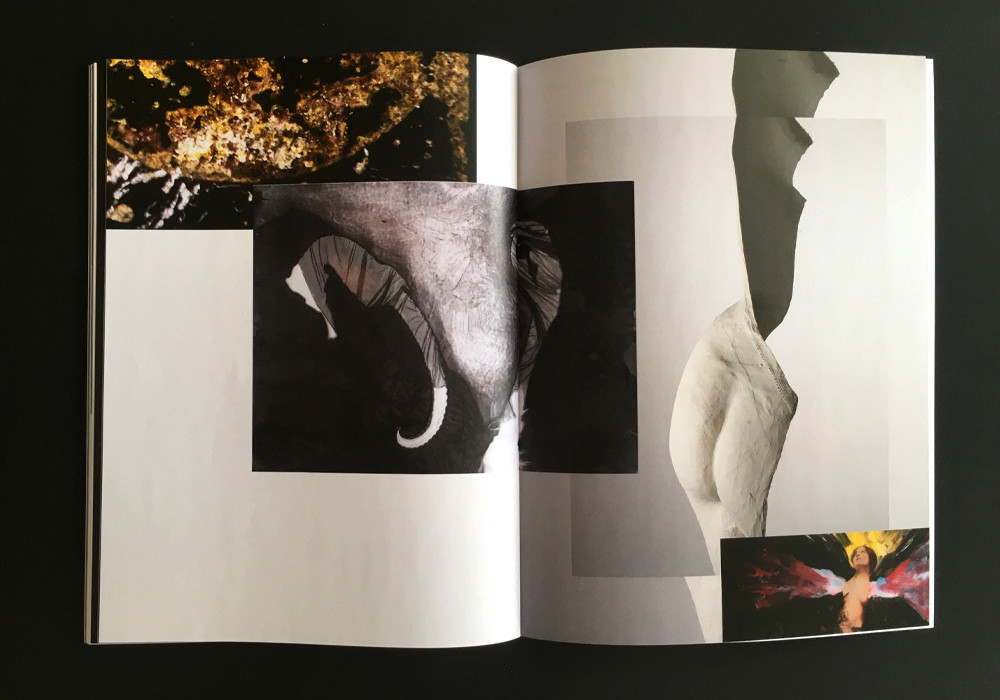

Expanded Nature

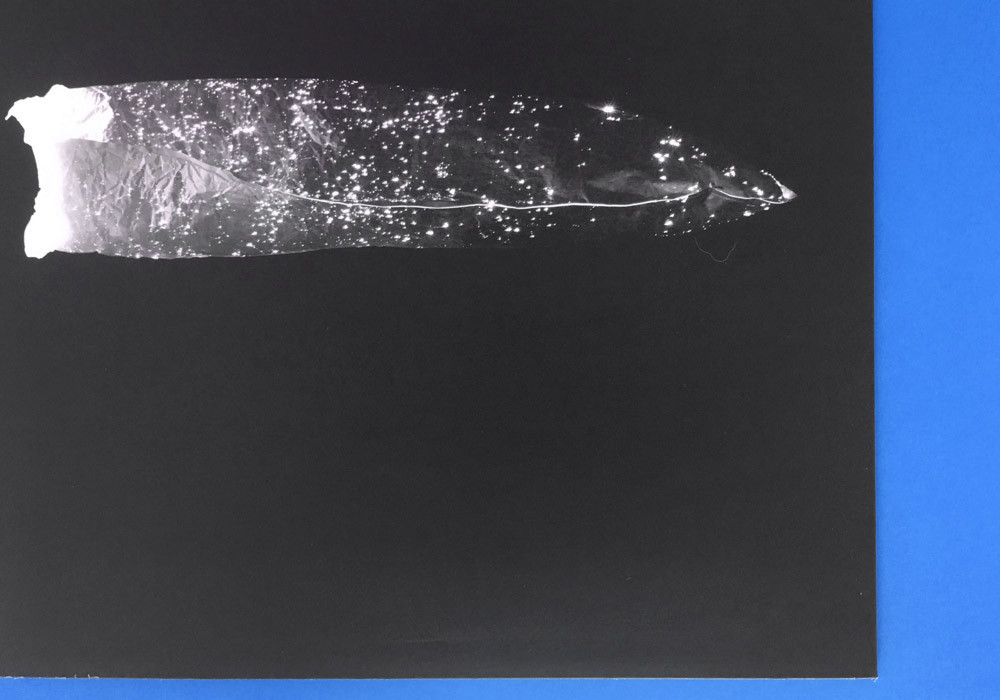

Light Cone édition

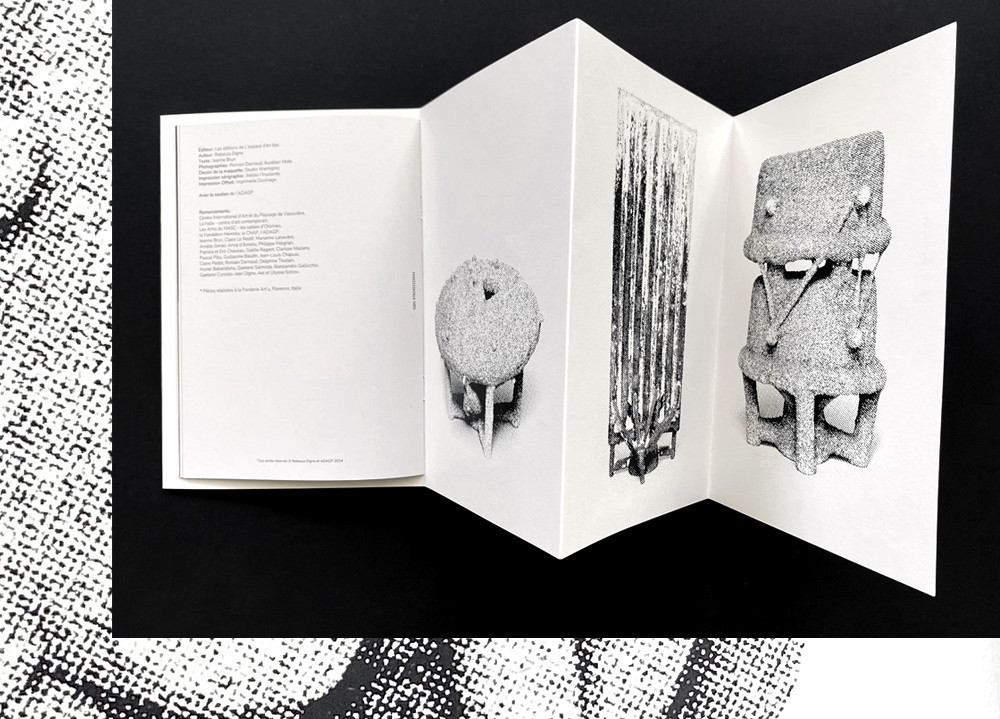

Quand l'œil Tremble, Le cinéma de Paolo Gioli

Rebecca Digne

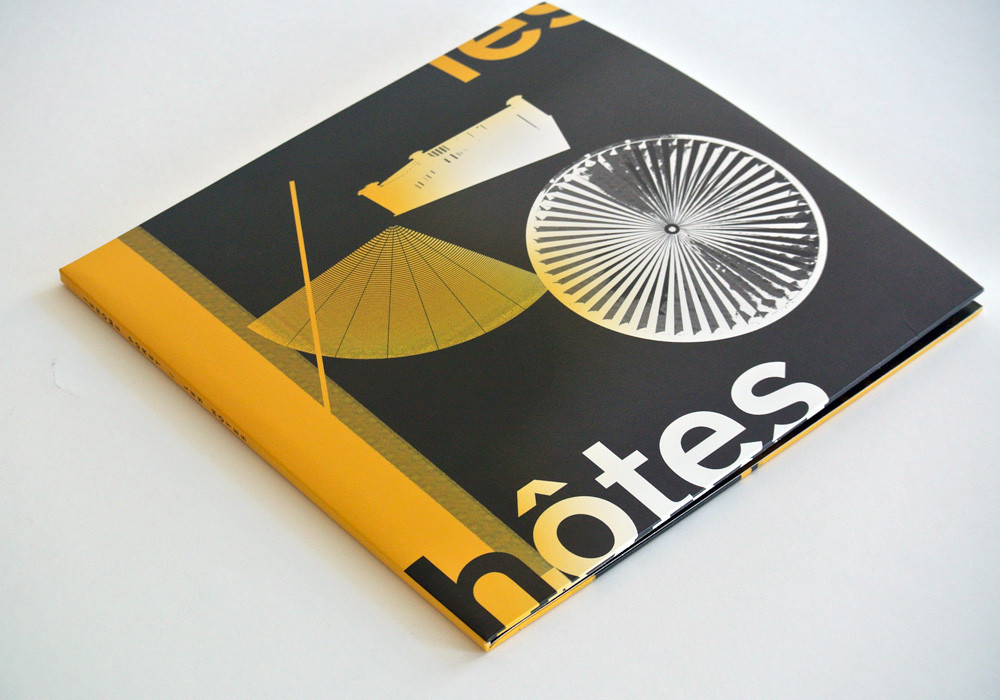

Les Hôtes

Centre d’art de la Maréchalerie

Engagés pour la qualité du logement de demain

Ministère de la Culture et Ministre chargé du Logement

Édition Parc des 12 saisons / Agence Taktyk Landscape

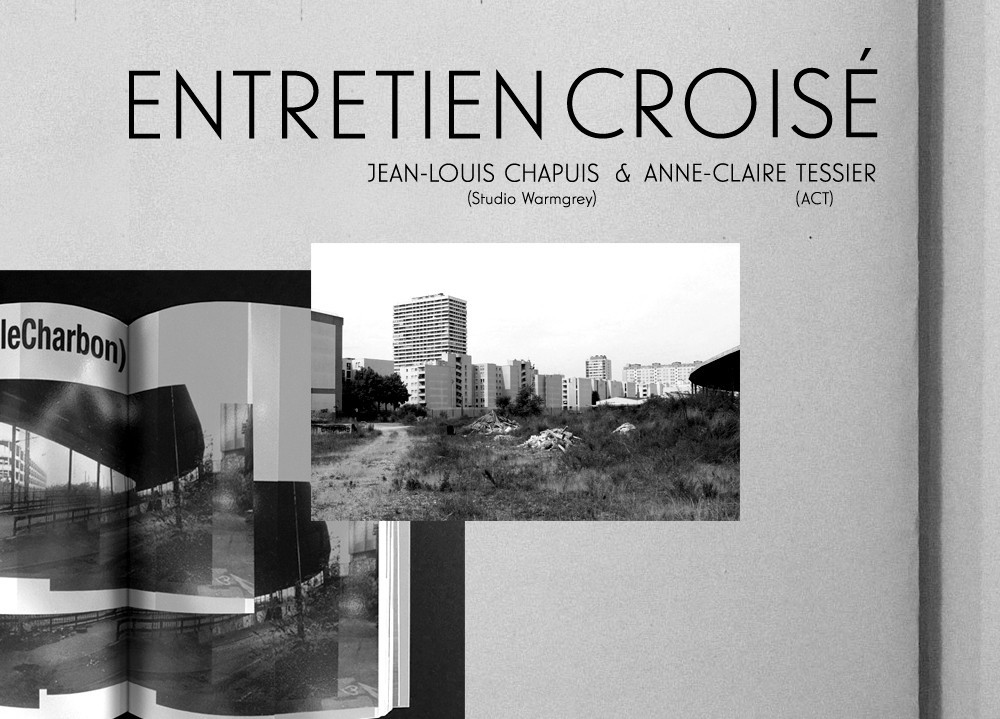

Chapelle Charbon

Entretien

Ailleurs & demain

+/-L’epicerie & The Film Gallery

Vers de Nouveaux Logements Sociaux 1&2

Cité de l'Architecture et du Patrimoine

Caler, décaler / Vincent Ganivet

Nord Sonore

Fonds Podium Kunsten Performing Arts Fund NL

+/-L'épicerie 1998-2004 le Catalogue

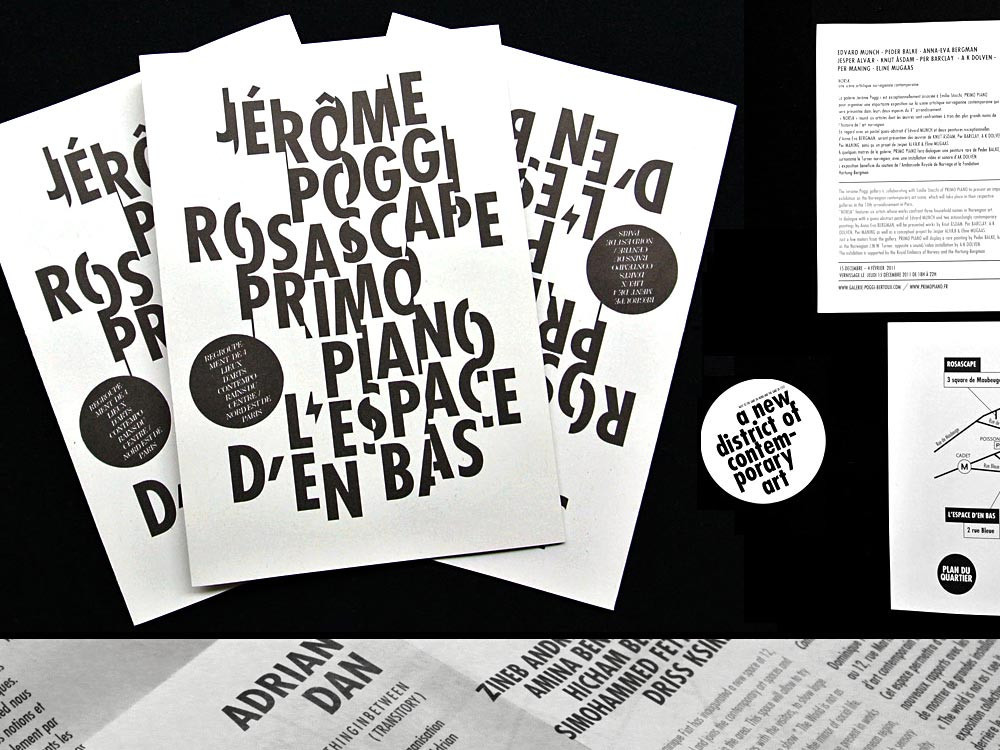

Les éditions de L'espace d'en bas

ISEA2023

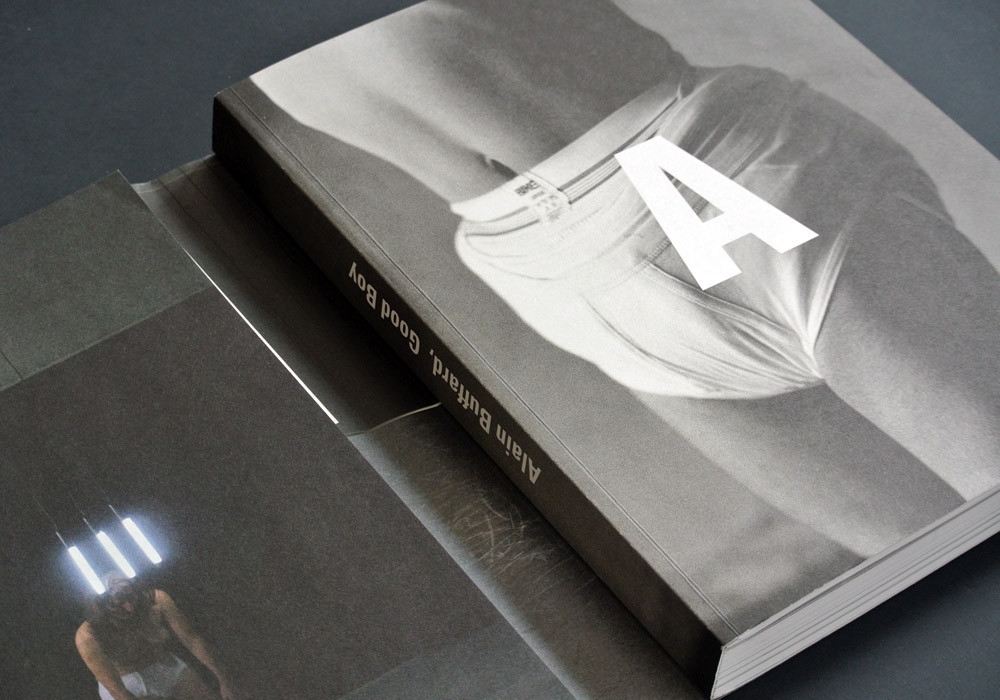

Alain Buffard, Good Boy

Centre national de la danse - CND

Ville de Pantin

Espace participatif

Messages / Images

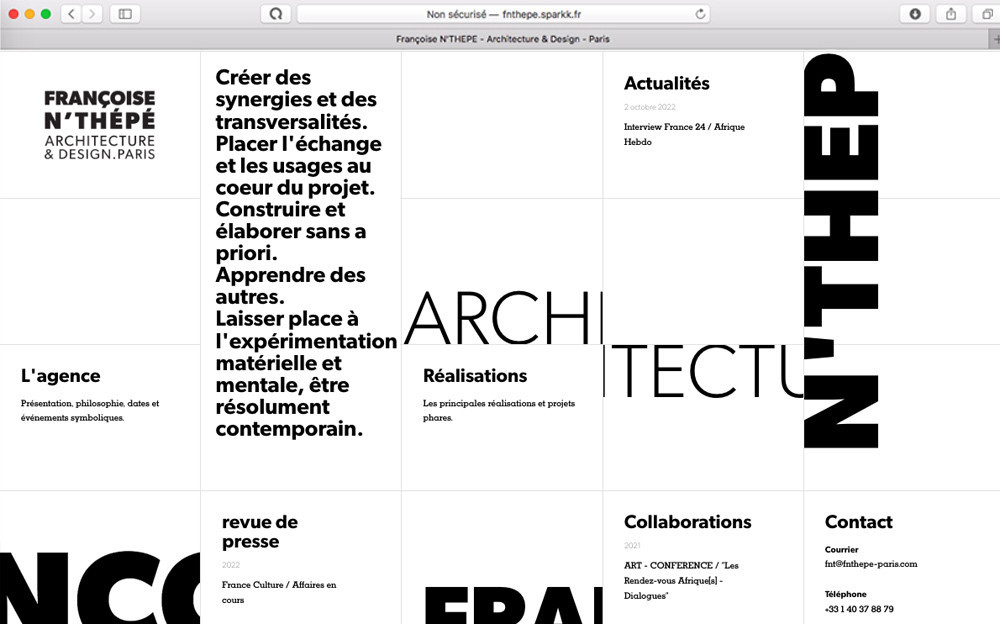

Françoise N'Thépé Architecture

Mon amour Vol.2

Eric Pougeau

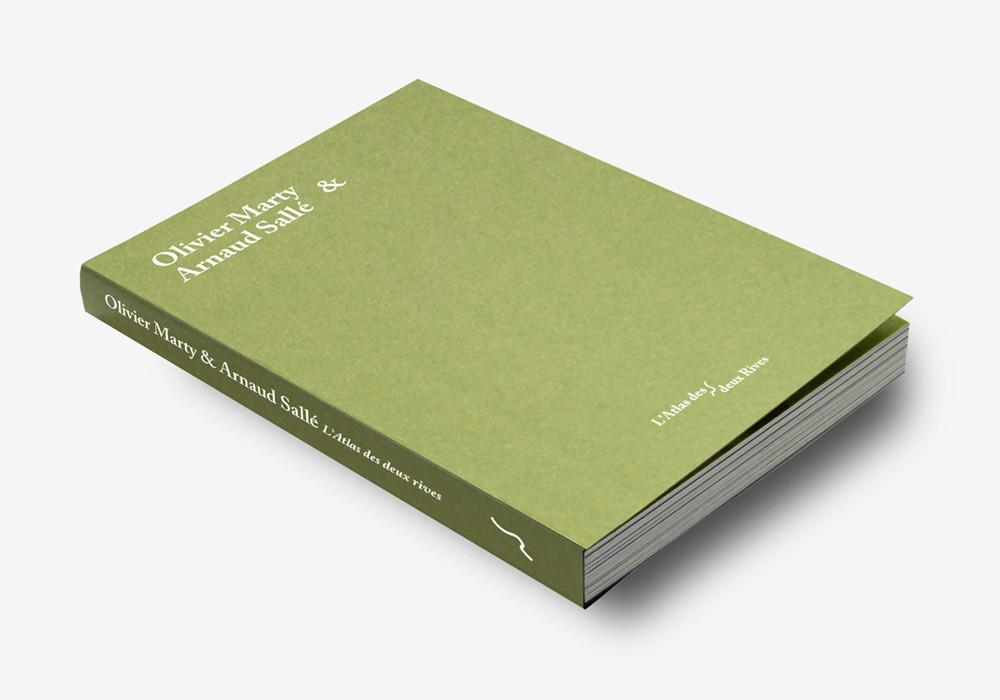

Atlas des deux rives

Conseil départemental de la Creuse

Olivier Marty & Arnaud Sallé

Olivier Marty & Arnaud Sallé

Usine Bollène

Compagnie Nationale du Rhône

Fabernovel

Signalétique

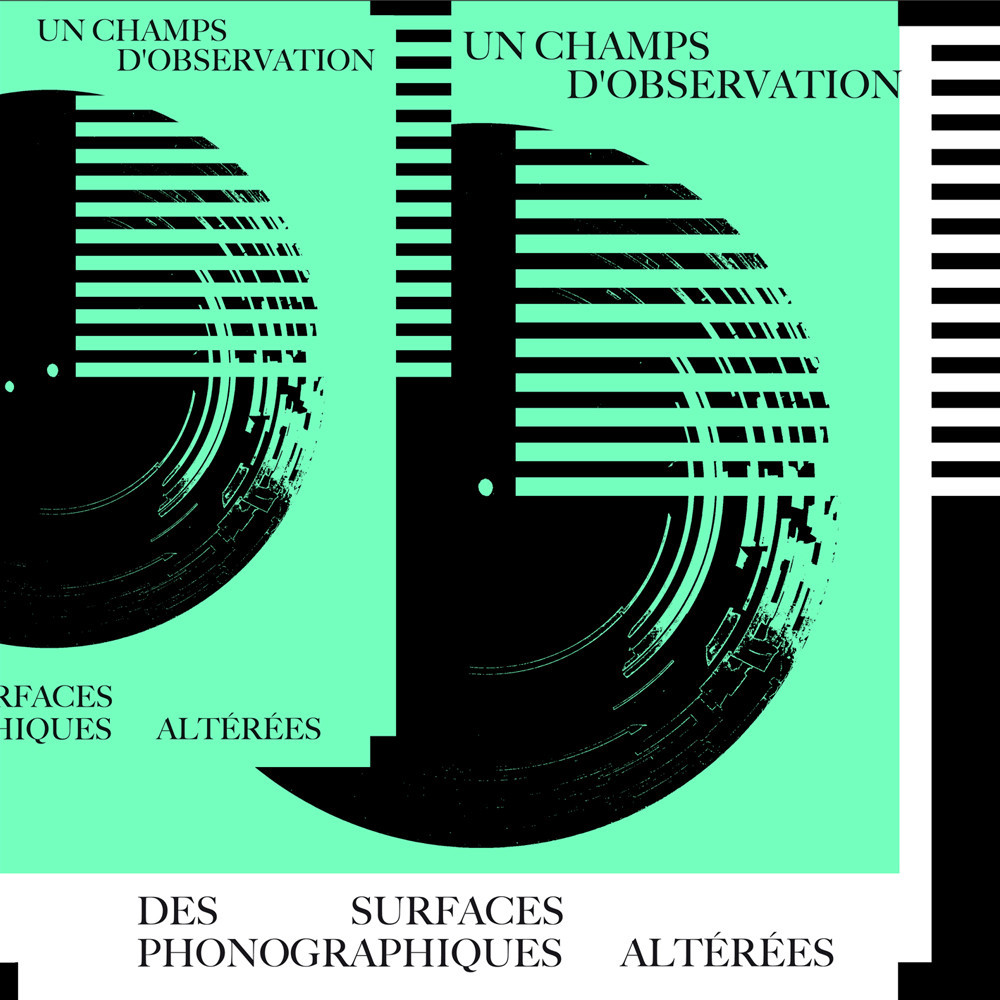

CHAMPS D'OBSERVATION PHONOGRAPHIQUE

Centre de tri Athanor

Saint-Pierre-en-Auge

Hollozone

Sister Iodine

Registre

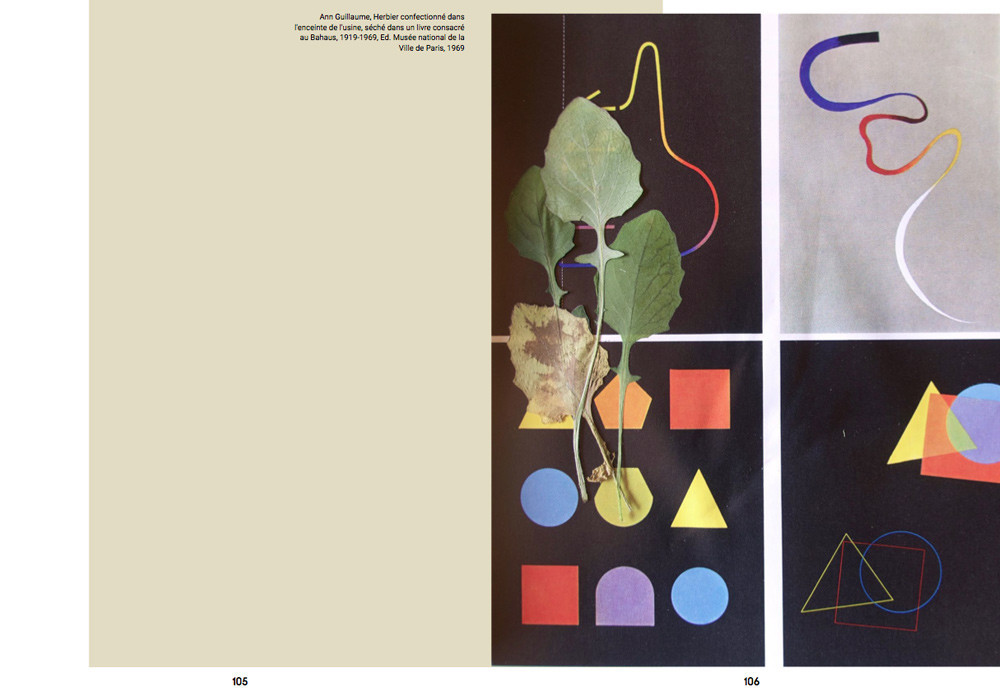

Ann Guillaume

Le Musée du monde en Mutation

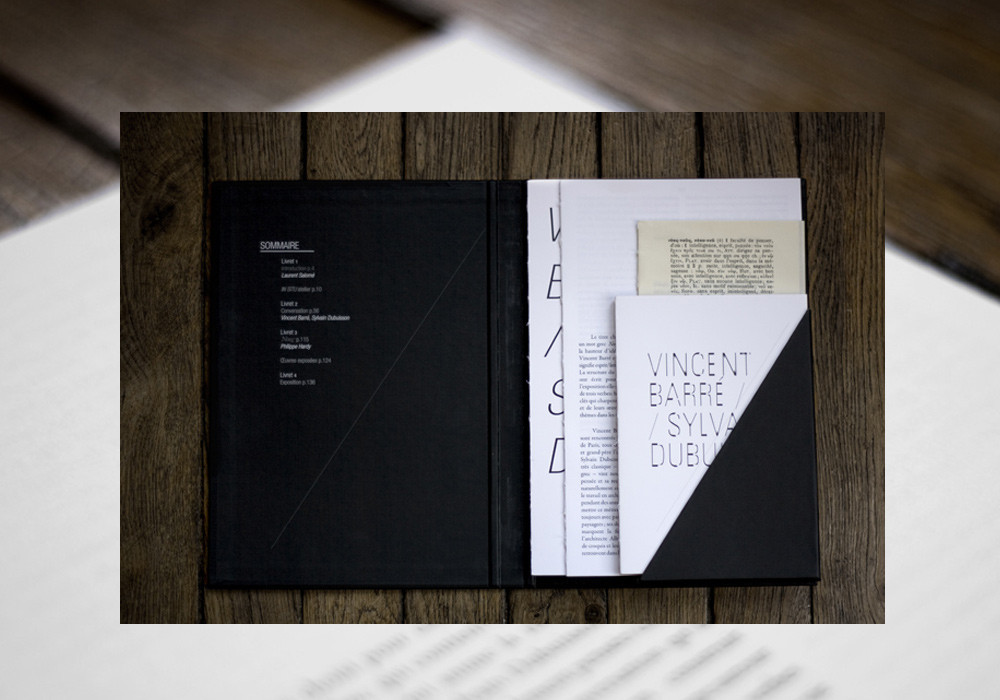

NOVS, Vincent Barré / Sylvain Dubuisson

Musée des Beaux-Arts de Rouen

Book, Françoise N'Thépé Architecture

Faire si chaud les étés derniers

Les éditions de l'espace d'en bas

La revue d'urbanisme

Sans images ni soleil

Workshop, TALM Le Mans

The Film Gallery

Re: voir édition

Erreurs Salvatrices

La Muse en circuit

Cie John Corporation / Émilie Rousset

Le musée du Monde en mutation

Syctom & SUEZ France

Chapelle Charbon / Mairie de Paris

Atelier / workshop

Timalets Partners

La Teinturière de la Lune

Label 69

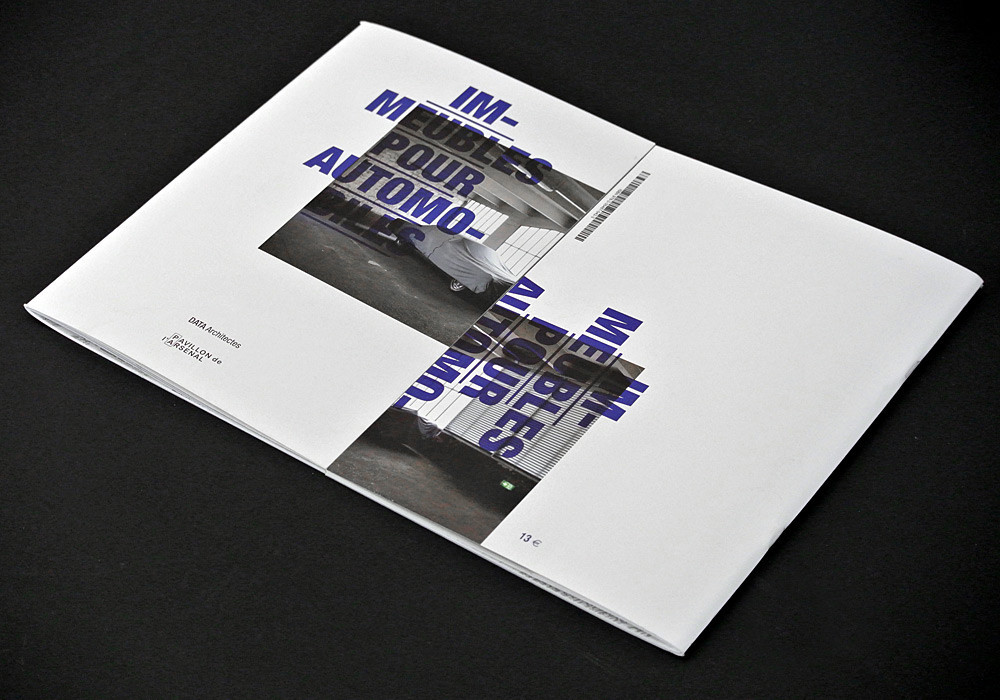

Immeubles pour automobiles à Paris, Histoire et transformation

Pavillon de l'Arsenal

jeu vidéo l’expo

Cité des Sciences et de l'Industrie ( EPPDCSI )

Studio Mustard

Impression 3D, l'Usine du future

Le lieu du design

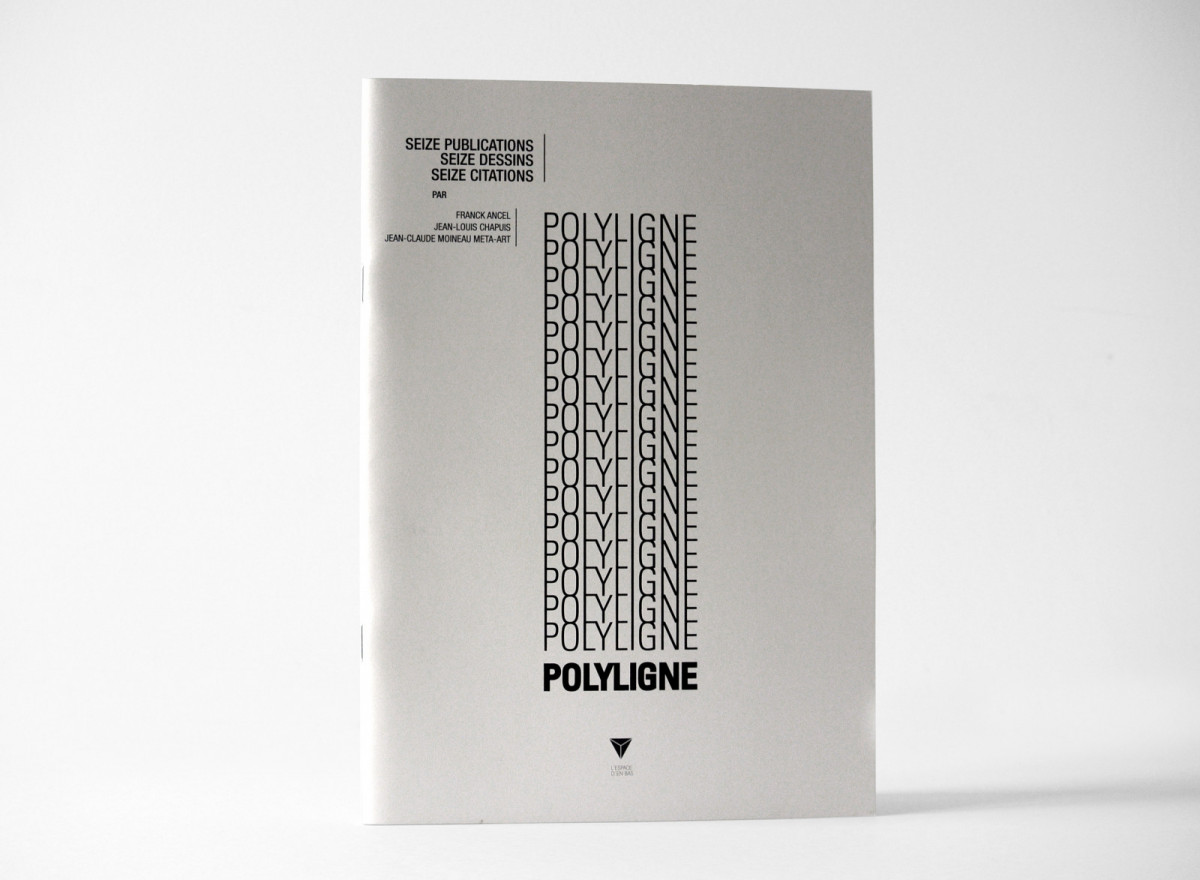

Polyligne

Les éditions de L'espace d'en bas

Ecole Nationale supérieure de Paysage Versailles

Workshop

Édition Julliard

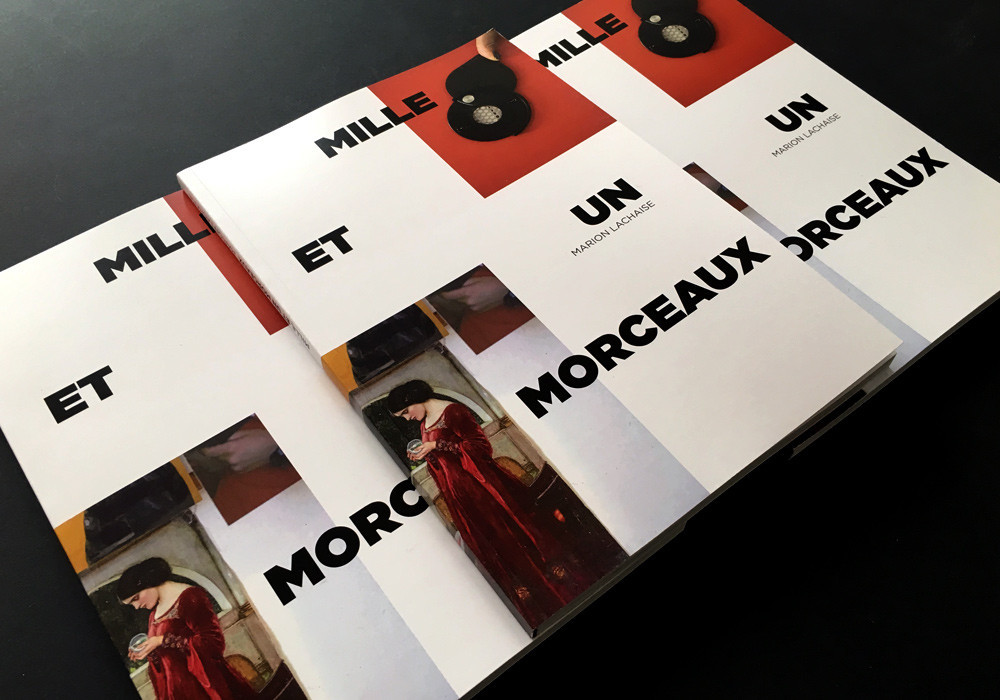

Mille et un morceaux

Scopique Studio

Les Géographies irrégulières

Pierre Giquel

L'espace d'en bas 2009-2019

Les éditions de L'espace d'en bas

Centre de découverte de la biodiversité Beautour

Région des Pays de la Loire

Bande annonce

Workshop, École nationale supérieure de paysage de Versailles

Quitter les victoires

Les éditions de L'espace d'en bas

Biennale de Rennes

Ensemble continu

Les éditions de l'espace d'en bas

Registre

Les éditions de l'espace d'en bas

Musée National Picasso-Paris

Journées Européennes du Patrimoine

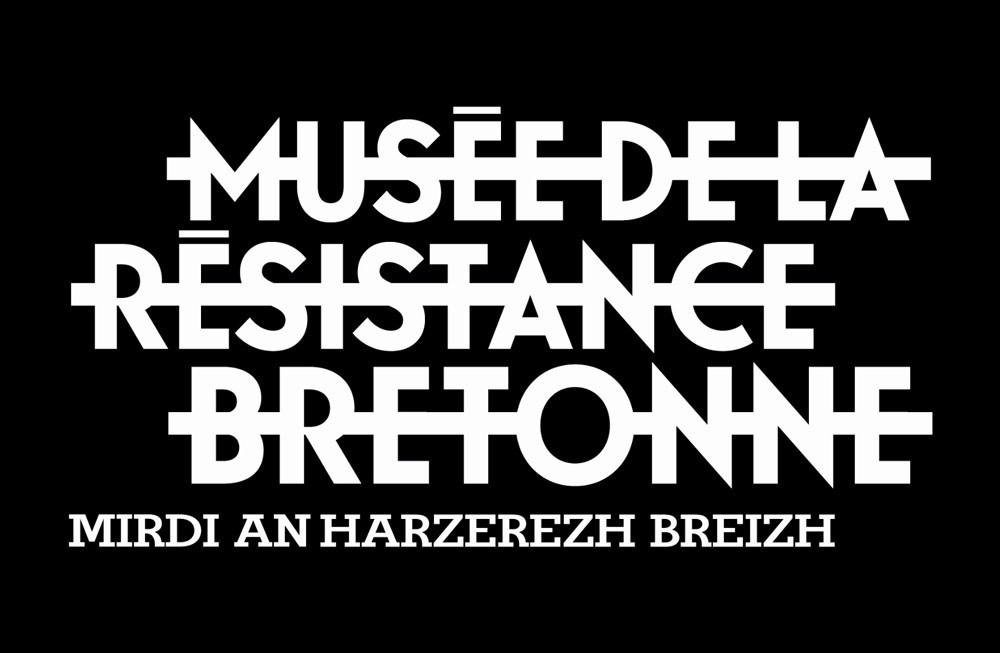

Musée de la résistance en Bretagne

Agence d’architecture Guinée&Potin

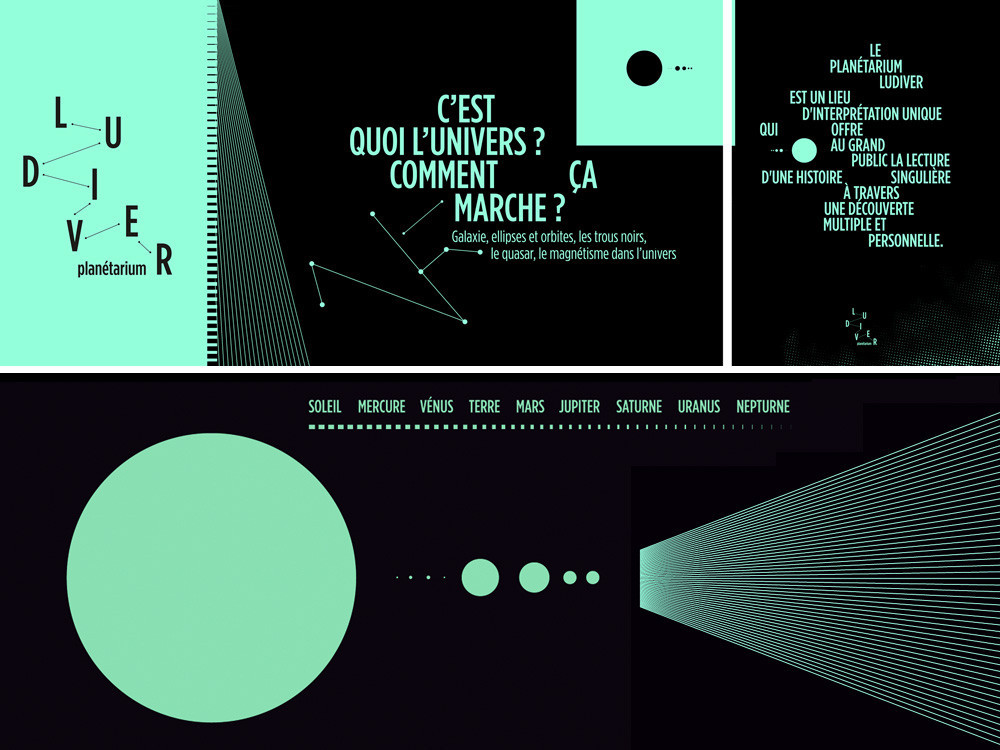

Planétarium Ludiver

outliner

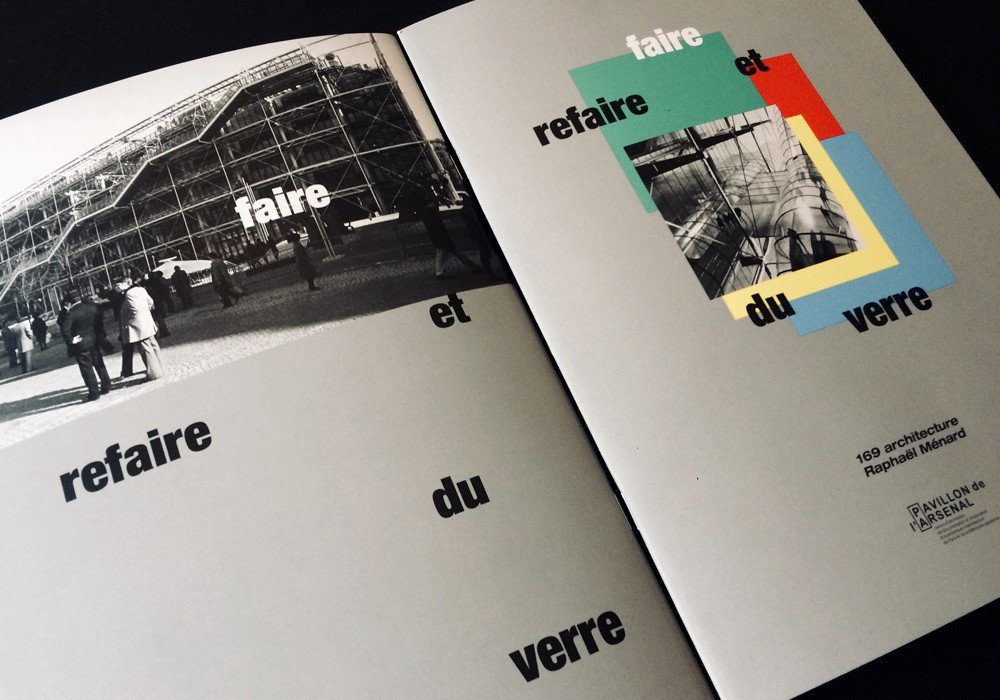

FAIRE Paris 2018

Pavillon de l'Arsenal

Palazzi di l’Americani

Musée de la Corse de Corte

La teinturière de la Lune

Instants Chavirés

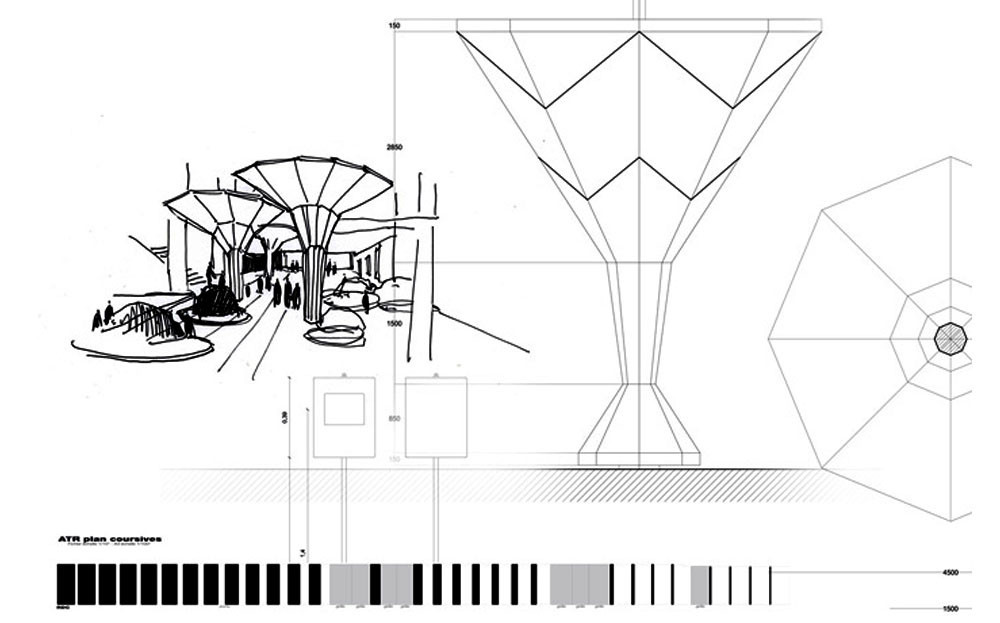

Jean-Benoit Vétillard architecture

Jean-Benoit Vétillard architecture

Palais de Chaillot

Cité de l'Architecture et du Patrimoine

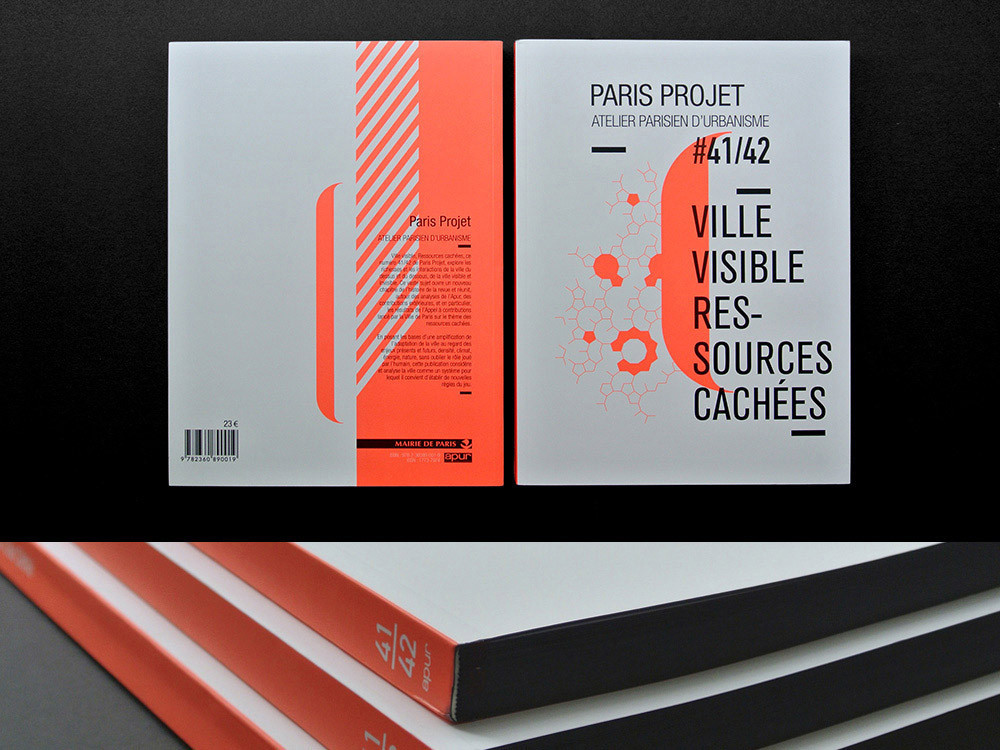

Atelier Parisien d'urbanisme

Atelier parisien d'urbanisme ( APUR )

Cartier Joaillerie

Juste un Cloux

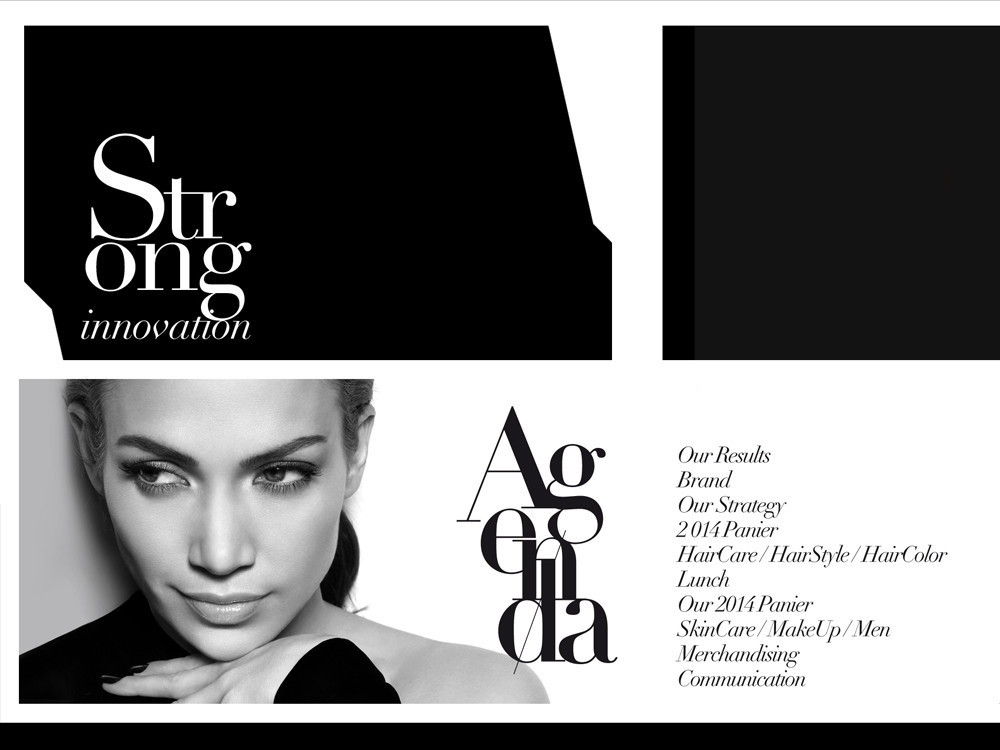

L'Oréal Worldwide Paris Show II

Mondiales L’Oréal

Agence d'architecture Jean Bocabeille

École Nationale Supérieure d'Architecture Paris-Malaquais (ENSA)

Workshop

Rozo architecture

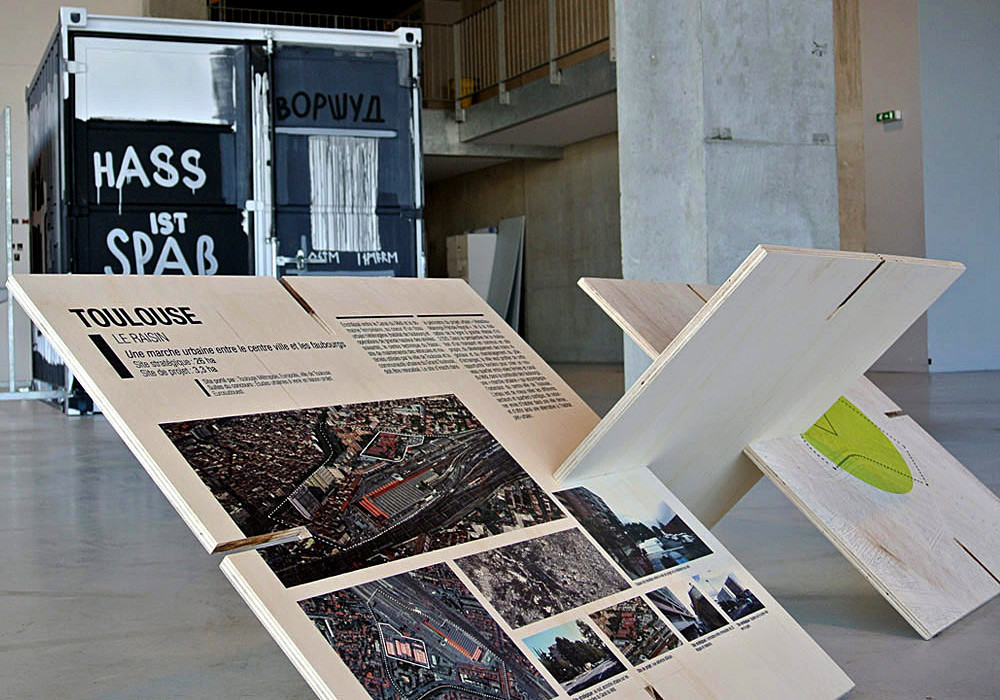

Europan France

Ecole Nationale Supérieure d'Architecture de Nantes

Georges Durand, Centre régional de la biodiversité

Région des Pays de la Loire

Sylvain Dubuisson architecture

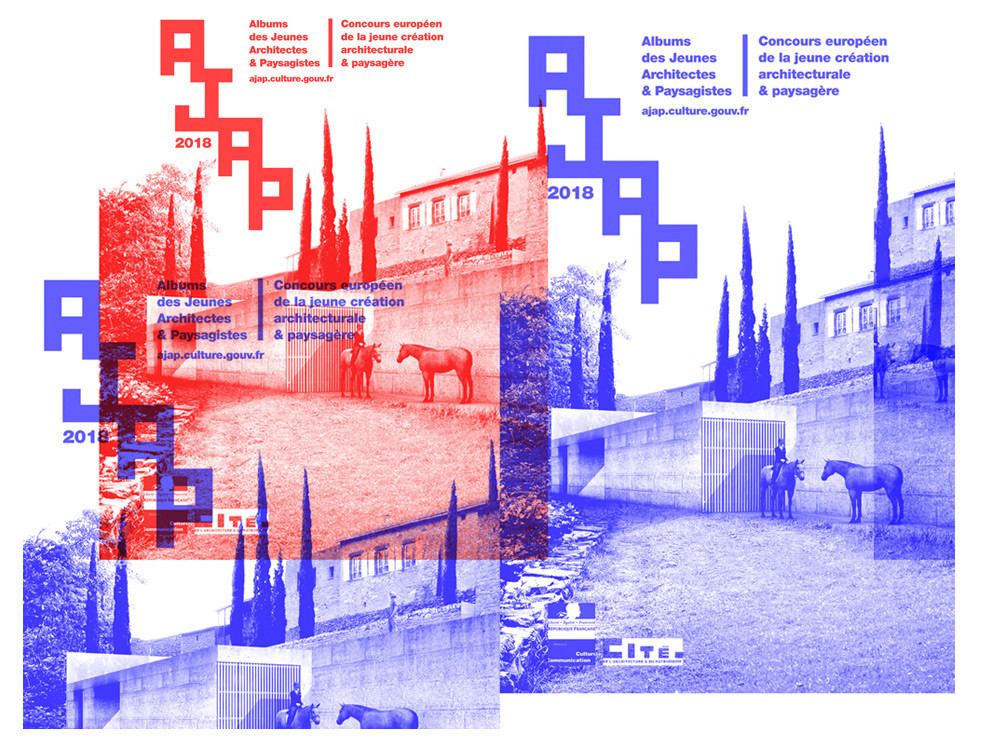

AJAP 2018

Cité de l’architecture et du Patrimoine

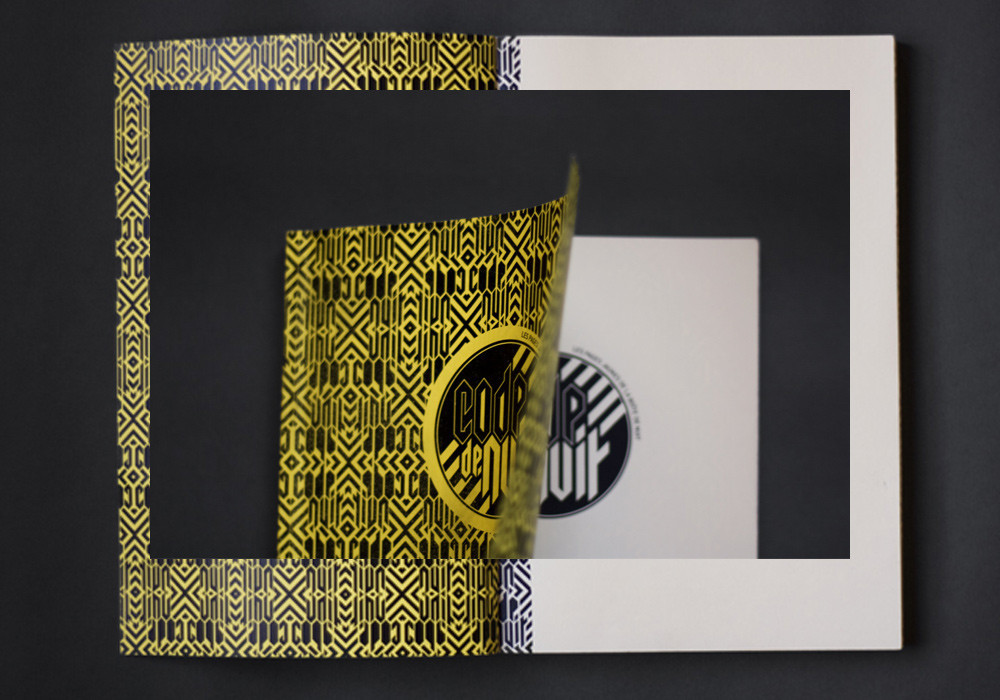

Code de Nuit

Cécile Paris

Biscornet

Édition de la French Touch

Marché Paul Bert & Serpette

Puces de St Ouen

Rosebud Dead or alive

Laura Brunellière

muséum National d'histoire Naturelle

Workshop ÉSAD Orléans

École Supérieure d’Art et de Design d’Orléans/ESAD

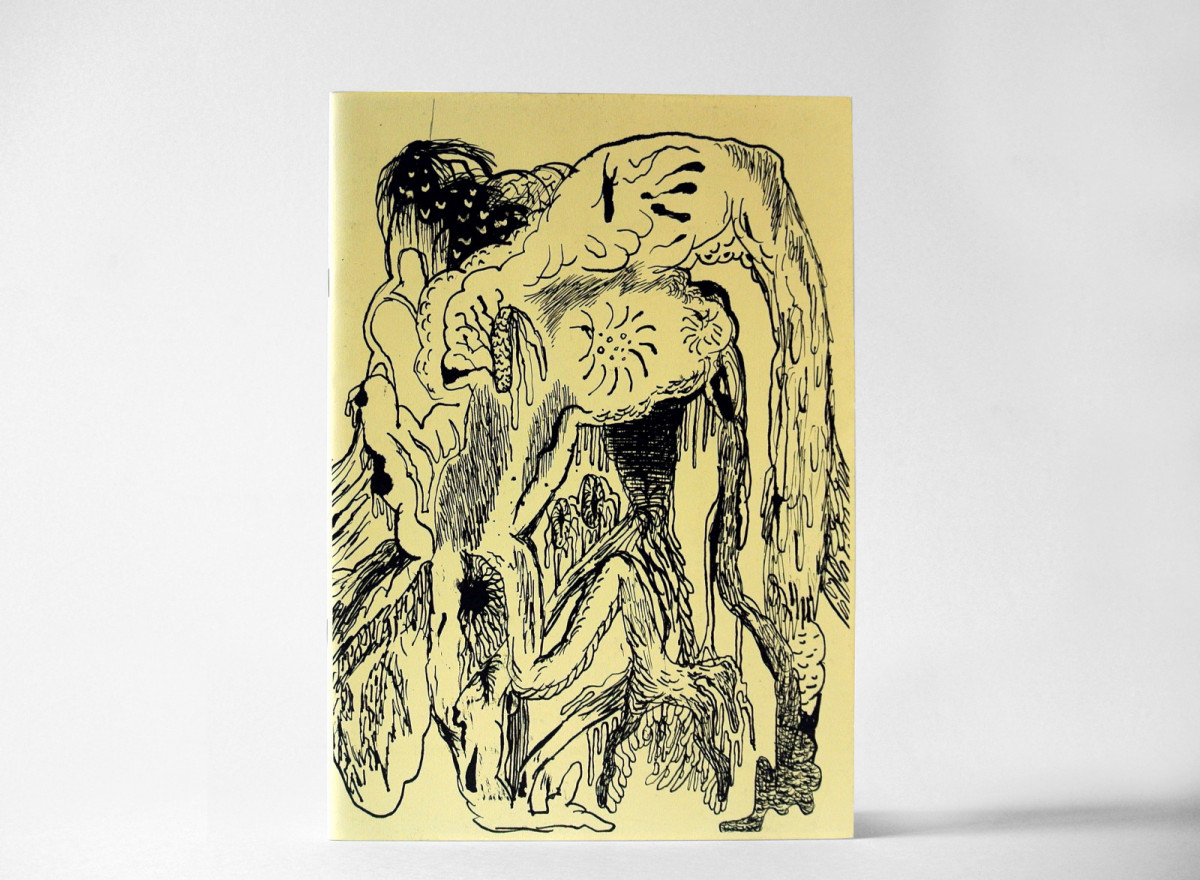

Fine young cannibals

Les 12 Campus du 21 ème siècles

Cité de l'Architecture et du Patrimoine

New District

Jérôme Poggi, Rosascape, L'espace d'en bas, Primo Piano

LE BRUIT DE LA CONVERSATION

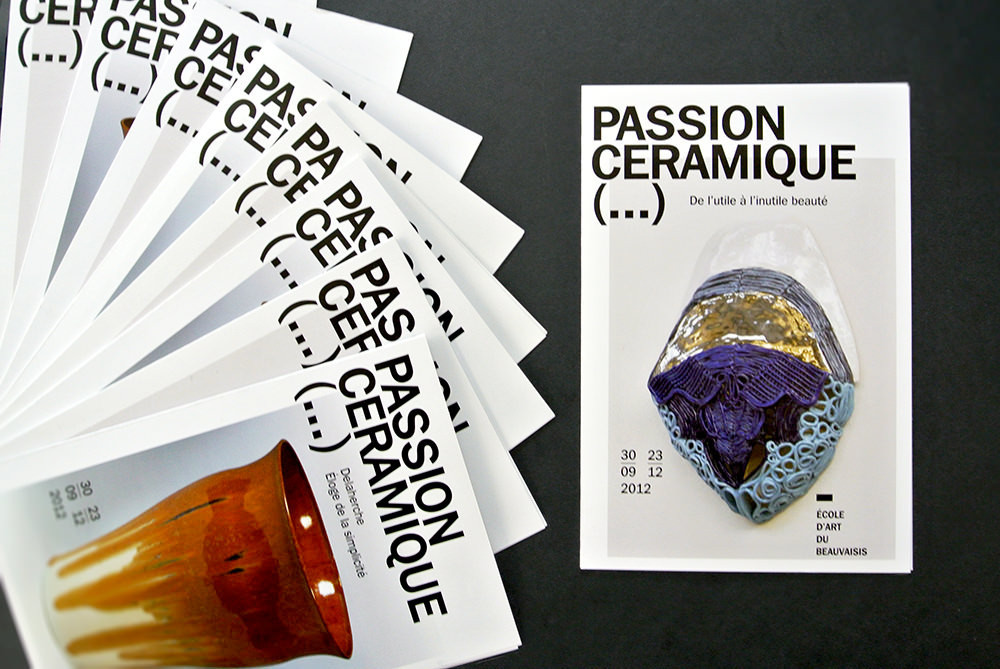

Passion Céramique

Musée départemental de l'OIse

Twingo Parade

Atelier Renault

Verilin

Ode à la nouvelle BB

Métropole de Nantes / Saint-Nazaire

Scot Nantes / Saint Nazaire